Selling an inherited property in Rockwood, Ontario can be a challenging process, especially with tax implications to consider. This guide provides essential information on the tax aspects and valuable tips to ensure a successful sale in this picturesque town.

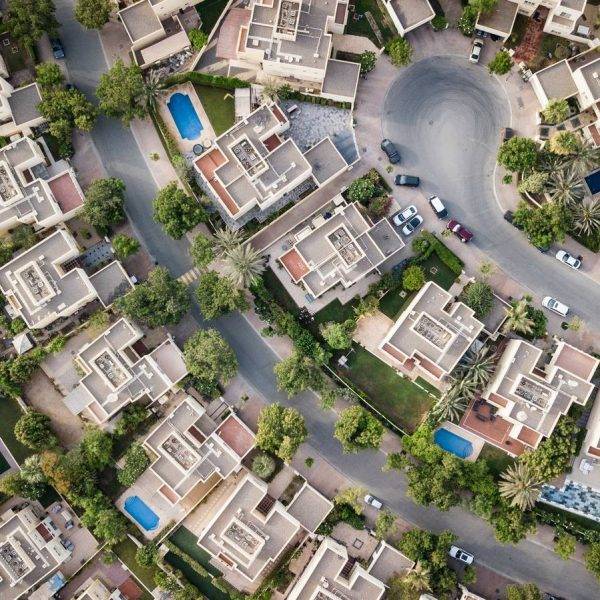

A Look at Rockwood, Ontario: Rockwood is a small town located in the province of Ontario, Canada. Its tightly-knit community, low cost of living, serene atmosphere, and excellent amenities make it an attractive destination for retirees and young couples alike.

Understanding the Tax Implications:

- Capital gains tax: In general, inherited properties are exempt from capital gains tax if sold by the person who inherited them. However, if the property is sold for less than its fair market value, capital gains tax may apply.

- Inheritance tax: Ontario does not impose an inheritance tax on property inherited by heirs and beneficiaries upon the death of the owner.

- Land transfer tax: When selling the inherited property, you’ll be required to pay a land transfer tax, calculated as 0.5% of the property’s fair market value.

- Real estate commission: As the seller, you’ll be responsible for covering the real estate agent‘s commission, which is typically around 5-7% of the sale price.

Tips for Selling Inherited Property Successfully:

- Engage a real estate agent: Partner with an experienced real estate agent who knows the local market and legalities, making the process smoother and more efficient.

- Research the market: Stay informed about the latest market trends in Rockwood and nearby areas to determine a competitive pricing strategy and negotiate effectively.

- Maintain and repair the property: Before listing the inherited property, ensure all necessary repairs and maintenance are done, enhancing its appeal to potential buyers.

- Stage the property: Present the property in its best light by staging it appropriately to help potential buyers envision themselves living there.

- Organize paperwork: Be well-prepared with all the necessary legal paperwork and disclosures to expedite the sale process.

Selling an inherited property in Rockwood, Ontario involves navigating tax implications and following essential tips for a successful sale. By collaborating with a reliable real estate agent, conducting market research, maintaining the property, staging effectively, and ensuring proper documentation, you can achieve a smooth and prosperous property sale.

FAQs:

- Is the sale of inherited property subject to capital gains tax? Yes, the sale of inherited property is generally subject to capital gains tax. However, if the property is sold for less than fair market value, then the capital gains tax may still be applicable.

- Is inheritance tax applicable to property inheritance in Ontario? No, inheritance tax is not applicable to property inheritance in Ontario.

- What is the land transfer tax rate in Ontario? The land transfer tax rate in Ontario is 0.5% of the property’s fair market value.

- What are the best tips for selling inherited property successfully? The best tips include partnering with an experienced real estate agent, researching market trends, maintaining and repairing the property, staging effectively, and organizing paperwork.

- How much is the real estate agent‘s commission when selling an inherited property? The commission is typically around 5-7% of the sale price.